Financial freedom is often associated with high income, large savings, or inherited wealth. In reality, it usually begins with consistent investing habits built over time. One of the most accessible ways to start this journey today is to invest in stocks without paying unnecessary fees. With the rise of digital platforms and improved access to financial markets, individuals can now participate in equity investing without high entry costs.

For beginners, the idea of investing may feel complex or risky. However, modern stock trading apps have reduced many traditional barriers, allowing people to invest in stocks with small amounts of money and minimal charges. When fees are removed from the process, investors can focus more on learning, planning, and growing their portfolios steadily.

This article explains how investing without costs works, why it matters for long-term wealth, and how beginners can approach the stock market responsibly.

Understanding What It Means to Invest in Stocks for Free

Zero-Cost Investing Explained

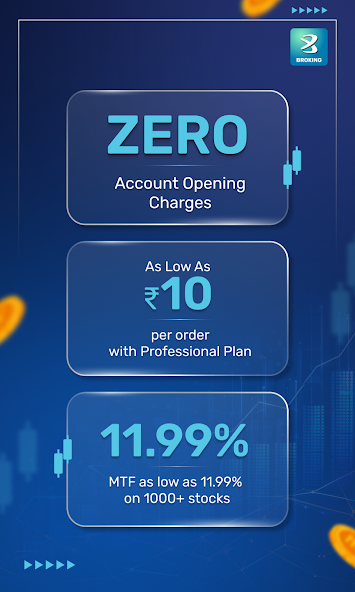

To invest in stocks for free means participating in the stock market without paying brokerage fees, account opening charges, or maintenance costs. Earlier, these expenses reduced returns, especially for small investors. Today, technology-driven platforms allow transactions at little to no direct cost, making investing more inclusive.

This does not mean investing without responsibility. Market risks still exist, and knowledge remains essential. However, removing fees helps investors keep more of their returns and encourages long-term participation.

Why Cost Matters in Long-Term Investing

Even small charges can have a significant impact over time. When investors pay fees on every transaction, it reduces compounding benefits. Investing without fees allows profits to stay invested, which supports steady portfolio growth over the years.

For beginners, this cost advantage makes it easier to experiment, learn, and improve decision-making without the pressure of losing money to charges.

How Stock Trading Apps Changed Investing Access

Easier Entry for Beginners

Digital platforms have simplified the investing process. Stock trading apps allow users to open accounts, track market movements, and place trades from a single interface. This ease of access has helped many first-time investors start earlier than previous generations.

These platforms usually provide educational tools, performance tracking, and basic market data, making them useful for learning and practice.

Control and Transparency

Investors now have greater control over their decisions. Real-time data and clear transaction records improve transparency. When people invest in stocks using these tools, they can monitor progress and adjust strategies without relying on intermediaries.

This direct involvement builds confidence and encourages responsible investing habits.

Why Investing Early Without Fees Matters

Compounding Works Better Without Costs

Compounding depends on reinvesting gains over time. When fees are removed, more money stays invested, increasing the effect of compounding. Starting early and staying consistent matters more than investing large amounts at once.

Investors who invest in stocks regularly without fees often benefit from smoother growth across market cycles.

Learning Without Financial Pressure

For beginners, early mistakes are part of the learning process. When there are no transaction costs, these mistakes are less expensive. This allows new investors to understand market behavior, risk management, and portfolio balance without discouragement.

Key Principles for Fee-Free Stock Investing

Focus on Long-Term Goals

Short-term trading often leads to emotional decisions. Investors aiming for financial stability should focus on long-term objectives such as retirement, education, or wealth preservation. Investing without fees supports long-term strategies by reducing unnecessary expenses.

Diversification Still Matters

Even when costs are low, diversification remains essential. Spreading investments across sectors and company sizes reduces risk. Investors who invest in stocks responsibly avoid concentrating all funds in a single asset.

Avoid Overtrading

Zero-cost platforms can encourage frequent trading. While trading may feel productive, excessive activity can increase risk. A disciplined approach with planned investments leads to better outcomes over time.

Common Myths About Free Stock Investing

Free Means Risk-Free

This is incorrect. Market risks exist regardless of fees. Stock prices fluctuate due to economic conditions, company performance, and global events. Understanding risk is essential before investing.

Only Experts Can Succeed

Modern tools have made investing more accessible. While experience helps, beginners can succeed by learning fundamentals, staying patient, and making informed decisions.

How to Build a Habit of Investing Without Fees

Start Small and Stay Consistent

Consistency matters more than amount. Investing small sums regularly helps build discipline. Over time, this habit creates meaningful wealth without overwhelming financial pressure.

Track Progress and Review Periodically

Monitoring investments helps identify strengths and weaknesses. Reviewing performance periodically allows investors to adjust strategies while staying aligned with long-term goals.

The Role of Knowledge in Free Investing

Understanding Market Basics

Investors should learn how markets function, what affects stock prices, and how economic changes influence returns. Knowledge reduces fear and improves decision-making.

Avoid Following Trends Blindly

Market trends change quickly. Successful investors rely on research rather than short-term popularity. A calm and informed approach supports stable growth.

Conclusion

Financial independence does not require complex strategies or large starting capital. It begins with informed decisions, patience, and consistency. When people invest in stocks without paying unnecessary fees, they give themselves a stronger foundation for long-term growth.

Modern stock trading apps have made investing more accessible than ever, allowing individuals to invest in stocks with greater control and clarity. While risks remain, removing costs improves compounding potential and supports learning without excessive pressure.

By focusing on long-term goals, avoiding emotional decisions, and building steady habits, investors can move closer to financial freedom. Starting early, staying informed, and choosing cost-efficient methods can make a meaningful difference over time.