Witness The Changing Financial Habits Of Millennials

Millennials have grown up with integration in the digital era; they know exactly how things function and how these advancements have made things easier, not only in terms of lifestyle but also without financial needs. An online loan is a product of this very technology, and indeed, it has been helping us with immediate financial needs.

The Rise of Fintech

Financial technology, also known as fintech, has created a revolution that has changed the face of finance and made it much more convenient and accessible. These two words are the driving force for the widespread adoption of the fintech revolution. Millennials have welcomed services like robo-advisors, AI chatbots, payment apps and others with open arms.

Financial Challenges Faced by Millennials

Despite their digital prowess, millennials face unique financial challenges that have shaped their financial habits. Some of the major challenges are:

- Student Debt

A lot of students enter the workforce with the burden of student loans, and this debt also impacts their ability to save and invest. These burdens need instant solutions like instant loans that not only provide immediate funds but also should be easily accessible.

- Housing Market Struggles

Housing costs are no longer the same as it was a decade ago, so homeownership is getting difficult day by day. A money loan comes in handy in such situations where millennials can take loans for their dream home and pay it slowly and steadily.

- Gig Economy Participation

Millennials in this dynamic world are no longer sticking to one single job, but they try to explore different options like gig work, freelancing or others. With this flexibility, they also feel a lack of financial safety, like retirement plans or healthcare insurance. Instant loans can help them through the lean months through loan app India.

Instant Loans: A Tool for Financial Flexibility

Instant loans have gained popularity among millennials as a means to address immediate financial needs. Here’s how these loans fit into their changing financial habits:

- Quick Access to Funds

Instant loans through loan apps are easily accessible, as we are accustomed to instant gratification. This accessibility allows us to secure funds rapidly for our unexpected needs.

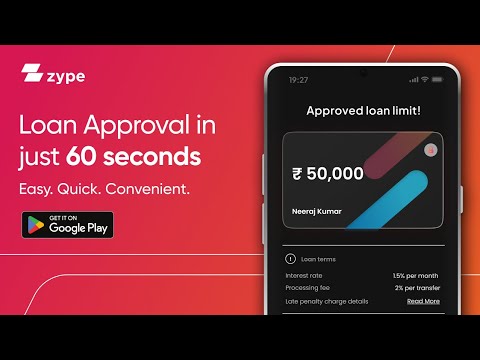

- Online Application and Approval

With technology, the loan process has also been simplified. We can apply for instant loans online sitting on our couch or lying on our bed, and with minimal paperwork, our application process is already completed. Within some hours, we can receive the mail for loan approval, making things super fast

- Flexibility and Customization

Instant loans have different types, from payday loans, where you get the funds you need, and then you pay it back on your payday; the other form is a personal installment loan, where you pay back in EMIs. Millennials can easily choose the one that fits their requirements and repayment capabilities.

Conclusion: Adapting to Change

Instant loans have become an important tool in a millennial’s financial toolkit and for all the right reasons. This choice of debt reflects the adaptability and tech savviness of this generation and also shows with responsible borrowing we can truly change the financial landscape.