In a time where digital transactions overwhelm, understanding the complexities of online instant loan has become significant for financial education. Let’s dive into the world of online credit and demystify the key terms and ideas that shape this budgetary scene.

1.Introduction to Online Credit

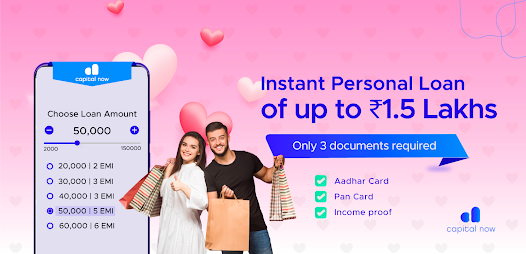

Online credit app alludes to the capacity to borrow cash through digital platforms. This helpful financial instrument has advanced with the rise of technology, permitting people to make purchases without making cash exchanges.

2.Credit Score: The Digital Financial Report Card

Your credit score acts as a numerical representation of your financial soundness when applying on a safe loan app. Extending from 300 to 850, this score is affected by variables such as installment history, credit utilization, and length of credit history. The higher the score, the more likely you are to be affirmed for online credit.

3.APR

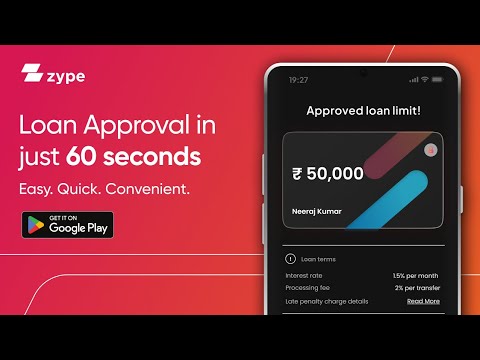

This Yearly Rate, or APR, speaks to the world of borrowing, where it counts incomes and expenses, and this is communicated as a yearly percentage rate. Understanding the APR is significant because it permits borrowers to compare different personal loan app.

4.Credit Limit: Setting Boundaries

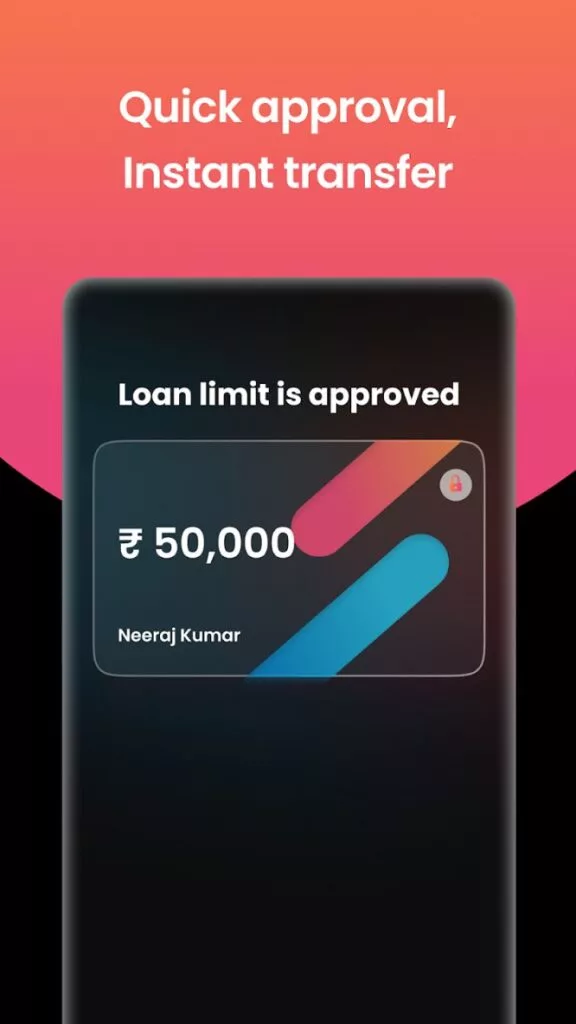

A credit limit is the most extreme amount a bank is willing to provide to a borrower. It serves as a boundary for borrowing and impacts your credit utilization skills.

5.Minimum Monthly Payment

The last month-to-month installment is the smallest sum you must pay to keep your account active. Whereas paying the least is basic to dodge late fines, paying more installments makes a difference and speeds up the repayment process.

6.Secured vs. Unsecured Credit

Secured credit requires collateral, while Unsecured credit doesn’t require collateral but may have stricter selection criteria. Knowing the difference makes a difference in borrowers selecting the choice that adjusts to their budgetary circumstances.

7.Cash Advance: Proceed with Caution

A cash advance permits you to withdraw cash above your credit limit. It may sound alluring, but be careful as these cash advances are also considered debts, and higher interest charges are charged on them, which could eventually increase your burden.

8.Introductory APR: Temporary Benefits

Introductory APR is offered by certain providers where a low or 0% interest is charged for a specific period. Although it is an alluring concept, we should also know about what happens when this period ends – the standard APR is charged to avoid unexpected costs.

9.Overdraft Protection

Overdraft assurance could be a highlight that anticipates exchanges from being declined if you surpass your approved credit limit. Whereas it can be helpful, it regularly comes with expenses. Understanding the terms and expenses related to overdraft assurance is fundamental to dodge unforeseen charges.

10.Credit Monitoring Services

This service tracks changes in your credit report, giving alarms for potential issues. Subscribing to such services includes an additional layer of security, making a difference as you can react instantly to any suspicious movement.

11.Late Payment Consequences

Convenient installments are vital for keeping up a positive credit history. Late installments do not result in expenses but also contrary affect your credit score. Understanding the results of late installments emphasizes the significance of financial education.

Conclusion:

Demystifying personal loan app online includes understanding these principal terms and ideas. Whether you’re new to digital money or looking to upgrade your financial knowledge, getting a handle on these elements engages you in forming educated choices, overseeing your credit capability, and exploring the ever-evolving scene of online borrowing.